Thought Leadership

Weakening UK Household Finances

Implications for non-bank lenders and auto ABS.

Analytical expertise by Fitch Rating s.

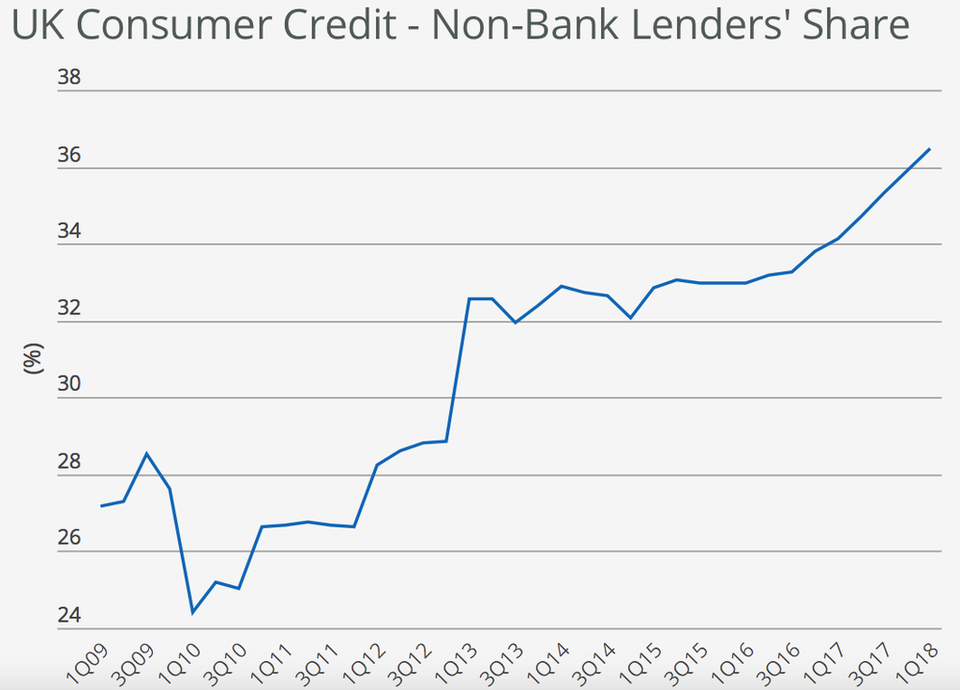

The UK household debt/income ratio has risen significantly in recent years and is likely to keep rising, given the sector's swing into a net financial deficit over the last year. The rise has been largely driven by growing consumer credit, notably car loans, and non-bank financial institutions (NBFIs) have an increasing share of the exposure. NBFIs' share of overall UK consumer credit (which excludes mortgages) rose from a post-crisis low of about 25% during 2010 to more than 35% during 2017.

NBFIs have benefited from tailwinds including record low interest rates and unemployment levels, as well as the formal banking sector exiting certain higher-risk segments. Low interest rates mean that the rise in debt/income has yet to increase the debt service burden. But the household sector's worsening financial health reduces consumer resilience to income or interest rate shocks, which could lead to pressure on lenders' asset quality.

A major interest rate shock appears unlikely (we forecast the UK base rate to rise gradually, to 1.25% by end-2019), but a more immediate shock could come from tightening credit supply. Brexit uncertainty increases the risk of a shock to economic growth and employment.

The extent of deterioration in conditions for lenders would depend on the pace at which unemployment, in particular, and interest rates might rise. The potential impact across UK NBFIs would not be uniform, as the sector comprises specialist lenders with different mixes of near-prime or sub-prime customers and various types of lending product, which could be affected in different ways.

The rated NBFI universe operating in this sector is small and tends to be sub-investment-grade, given its niche focus and the non-prime nature of the target market. Recent rating actions have been driven by the impact of changes in business models rather than deteriorating asset quality, but this could change if unemployment rises sharply.

Finance companies owned by motor manufacturers face increased risk of residual value-related losses, as a consequence of sharp increases in personal contract purchases and, to a lesser extent, falling demand for diesel cars.

Lending-oriented NBFIs have also been increasingly exposed to regulatory developments around pricing transparency, affordability and customer protection. There is evidence that the Financial Conduct Authority's focus on persistent debt has led some NBFIs to reduce their exposure to higher-risk (but also more profitable) customers or to lower their pricing, both of which would reduce their profitability.

Implications for auto ABS

Auto lending has been one of the largest contributors to the rise in UK consumer debt since 2016 and Fitch believes the increasing popularity of the Personal Contract Purchases (PC) product to be a key factor. BoE estimates suggest that the stock of car dealership finance rose by GBP30 billion between 2012 and 2016 – with most of this driven by PCPs – making it far and away the largest driver of rising consumer credit (excluding student loans). PCP agreements involve customers renting a new vehicle for three or four years with the option to make a final “balloon” payment – equal to the vehicle’s Guaranteed Minimum Future Value (GMFV) at the end of the rental period – or returning the vehicle to the financing company. The GMFV is set at the start of the rental period and an overly optimistic assessment could result in losses for lenders if consumers return vehicles at the end of the rental period with residual values below the GMFV.

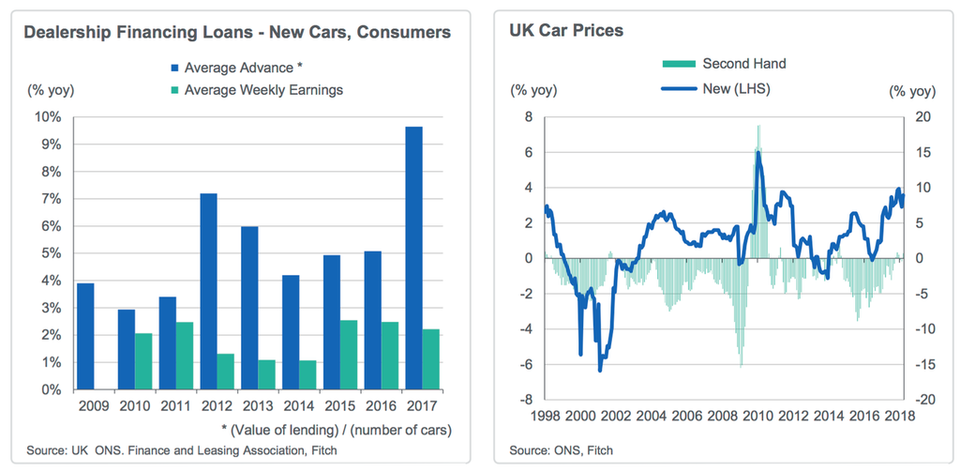

UK new car sales to private customers have actually been flat since 2014 – fleet business has been the sole driver of rising new car registrations between 2012 and 2017. However, along with a steady increase in the share of PCP in new car finance penetration, there has also been notable growth in average consumer auto loan advances, outstripping the annual growth in weekly average earnings every year since 2009. For 2017, this effect more than offset the first observed decline in new car registrations since 2011. The value of new car lending through dealerships grew by 4% yoy in 2017 while the number of new cars financed this way fell by 6%. As new car prices only rose 3% in 2017 (according to ONS figures) this either implies a shift in finance deals towards more expensive models, or, more likely, a rise in leverage associated with each new car financed this way.

Credit performance of the assets backing UK auto ABS has been excellent for at least the last five years and Fitch is not aware of indications of materially weakening underwriting standards in its rated portfolios. However, the rapid growth in PCP loans has also been reflected in their increased share in securitised portfolios, which has resulted in car market value risk (residual value, or RV, risk) replacing credit risk as the primary risk driver in UK auto ABS. Since September 2015, the ability of auto finance companies to correctly forecast used car values three or four years into the future has been tested by the emissions problems related to diesel engines. The sales data made available to Fitch indicated that the relationship between realised sales prices and projected values deteriorated for many lenders, but mostly remained within built-in safety cushions.

Nevertheless, the deteriorating financial position of UK households has the potential to weaken auto loan performance on both credit and residual value grounds. If a slowdown in consumer spending leads to rising unemployment, Fitch would expect loan defaults to increase simultaneously. In addition, while a variety of factors influence used car prices, Fitch considers that they would not be immune to a fall in consumer demand. ONS data in the chart below shows that the longer term trend is for used car prices to fall over time, both in absolute terms as well as relative to new car prices. Used car prices are also highly volatile. Despite the increased downside risks for UK auto loans, Fitch expects the ratings performance of outstanding auto ABS to remain robust. The stable ratings outlook for the sector is based on robust structural protection such as high credit enhancement, fast asset amortisation and short reinvestment periods, after which available cash is returned to investors.

Fitch Ratings