Inside the deal

Data: How did we do, where are we going?

There's no reason why backwards-looking economic data and forecast data should look alike, clearly, they are addressing different scenarios, draw on different datasets and are based on different assumptions, but the contrast between the two became surprisingly stark in June when the OECD and the BCC issued their outlooks for 2022 and beyond. Alejandro Gonzalez reports

Forward-looking data

If the Organisation for Economic Co-operation and Development is correct, once Russia is removed from its economic forecasting statistics, the UK will be the worst-performing economy among the G20 group of leading developed economies in 2022.

In a similar vein, the Britsh Chambers of Commerce (BCC), which represents tens of thousands of businesses across the UK of all sizes, says this year will see no growth in the 2nd and 3rd quarters and a shrinking of the economy of 0.2% in the final quarter of the year.

What does this mean for businesses? Costs of all types are expected to increase, from energy prices, shipping costs and raw materials. Also, demands for improved wages are expected to rise as the cost-of-living crisis begins to bite.

As margins narrow, businesses will be faced with making tough decisions about passing costs onto customers and/or making cuts and restructuring how they operate. In some cases, winding up the business or filing for bankruptcy will be the only solution. Those who do run viable operations will likely put off new investments as they look to hold on to their cash, particularly as customers defer spending given the uncertain outlook for 2022.

Backwards-looking data

Against this gloomy backdrop, is backwards-looking data issued recently, and independently, by UK Finance and Acquis.

According to UK Finance, bank lending in the first quarter of 2022 has signalled a gradual return to normal lending to SMEs across the UK.

A recent review, by the trade association for the UK banking and financial services sector, found a pickup in demand for cashflow finance through overdrafts and invoice finance and asset-based lending. It described this as "a consequence of both the end of Covid-19 restrictions and the significant increase in cost pressures that many businesses are now facing."

Following the significant growth in lending volumes in 2020/21 from the government’s Covid-19 lending schemes, demand for finance has been comparatively muted over the past year with gross lending of around £5bn per quarter from the high street banks covered in our sample, the trade body said.

During the first quarter of 2022 gross lending to SMEs was £4.9bn, £0.1bn higher than the previous quarter.

Stephen Pegge, managing director of commercial finance, said: "Finance usage and demand by SMEs shifted little in the early months of 2022. Overall lending has been broadly stable, but there has been a modest pick-up in new overdraft approvals and utilisation in addition to continued growth in invoice finance and asset-based lending advances. This is likely a response to the now complete reopening of all parts of the economy as well as the increase in cost pressures."

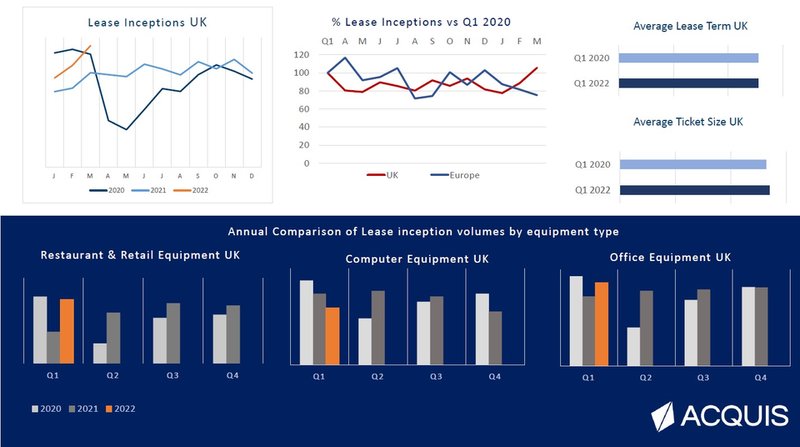

The latest Index – an economic indicator of how much equipment UK companies lease – has found that the proportion of new contracts signed by UK companies to lease essential items: is 29% higher than in March 2021, when the UK had been battered by the pandemic and was entering the third month of its third national lockdown, and is 8% ahead of the equivalent point in 2020 when the impact of the pandemic was yet to hit fully.

“By comparing pre-pandemic performance during Q1 2020 with current performance two years later in Q1 2022 – we can see that the recovery in the UK leapt ahead of Europe with volumes for the entire quarter tracking ahead of where they were before the pandemic hit, for the first time since the pandemic began, while in Europe volumes were over 20% down on pre-pandemic performance,” Acquis said.

The adage, "past performance is not a guarantee of future results" is well known in the investment world but is equally true when comparing backwards data with forecasts, one observer of UK leasing told me.

The same observer also said it is best to consult backwards-looking data when dealing with mature markets and a stable economic environment. That seems a tall ask these days when - it could be argued - that the commercial lending market is mature, but the economic environment is certainly not stable.

The European Investment Bank (EIB) and DLL Ireland have agreed to an €80m green business investment initiative that promises to promote new investments by Irish companies, farmers and entrepreneurs.

Fergal O’Mongain, DLL group treasurer and country manager, Ireland, said: "The partnership with the EIB will help Irish businesses adopt low energy and low emission equipment and machinery in addition to generating power by investing in renewable power technologies."

"The EIB is positioning itself as a climate change bank and Rabobank is looking to have a positive impact on society, so it was a natural fit for us to work together," he said.

DLL's initial partnership with EIB was in 2004 through Rabobank, the Netherland's second-largest bank in 2020 by assets and DLL's parent company.

Back then the nature of the partnership was to support Dutch SMEs but this relationship has developed over the decades into a wider pan-European cooperation, says O’Mongain.

From left: Fergal O’Mongain, country manager DLL Ireland and Christian Kettel Thomsen, vice-president of the European Investment Bank

"After the financial crisis of 2007-2008, with businesses finding it hard to borrow from banks, the EIB wanted to support the indigenous SMEs and mid-cap sectors and DLL was able to channel funds to those sectors through its network of partnerships with vendors and manufacturers.

"But, today the EIB-DLL partnership is focused on funding climate change initiatives around the circular economy and energy efficiency, which for us means working with our vendors to explore how to refurbish assets to give them a second or third life while also supporting their new products with finance offerings as they transition to more energy efficient models."

O’Mongain explains that one of the biggest obstacles for businesses in Ireland, and elsewhere, who want to transition to greener technology is the upfront capital needed.

"Technological improvements are enabling new assets to use battery power over traditional engines across many assets and a lot of capital expenditure will be needed to replace old technology with new technology, and we want to be part of facilitating and enabling that change."

The way the EIB funding works is that "for every euro given to us by the EIB, we match it with a DLL euro, the idea being that through the partnership, we double the size of the fund in the targeted area.

"The benefit for us is that the EIB also offers its funding at a small discount to commercial rates, which we're able to pass on to our customers."

As expected, a large part of DLL Ireland's funding is for the Agri sector, but DLL is also a player in refurbished wind farms, repowering wind farms, solar energy for smart buildings, electric vehicles for the construction, transport and industrial sectors as well as continuously evaluating new technologies such as anaerobic digestion (producing biogas from farm animal slurry).

Invoice financing also plays a role in funding some energy efficiency projects, says O'Mongain.

DLL's LED lighting projects in Ireland currently involve working with partners who identify clients willing to transition to LED lights. This typically involves no capital outlay by the transitioning business for the new lighting, however, the business is asked to pay roughly 80 per cent of what its historic energy bill has been for perhaps five years.

This outlay is calculated to pay for the project and to cover DLL's financing, and "after this initial period the customer is able to enjoy the full energy-saving potential from the LED lights, which might see the business paying out 30-40% of its previous energy bill," he says.

This would involve DLL purchasing receivables as part of this funding arrangement, O'Mongain explains.

This particular EIB agreement with DLL Ireland is part of a wider pan-European green financing programme being undertaken by the EIB and DLL with a total value of €200m. This wider programme will include targeted financing for climate action investment by DLL in Belgium, the Netherlands and Luxembourg.

It will support DLL business financing over the next years and include leasing financing for agriculture and food businesses and other energy-efficient projects.

The legal agreement for the EIB support for DLL climate action leasing financing in Ireland is expected to be finalised in the coming weeks.

In 2020, the EIB Group provided €1bn for new private and public investment in Ireland.

DLL Ireland was established in the early 90s, with DLL's domestic vendor focused leasing activity in Ireland having started in 2012.