Thought Leadership

Sponsored by Fitch Ratings

Fitch Ratings 2021 Outlook: EMEA Developed Markets Leasing

Fitch anticipates a difficult operating environment for many EMEA developed markets finance and leasing companies in 2021, with the fallout from the coronavirus pandemic continuing to exert a negative influence well into the year. However, near-term liquidity is supported by the actions many issuers have taken both before and since the onset of the pandemic to lengthen their maturity profiles.

Commercial Fleet Lessors: Downside Risk from Higher Residual Value Risk and Worsening Credit Exposure but Resilient Business Models Support Credit Profiles

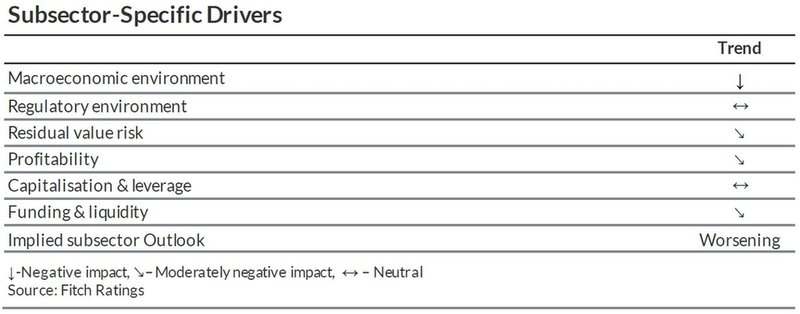

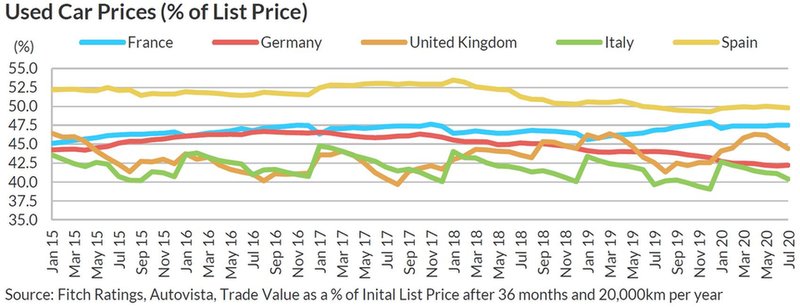

Fitch expects pressure on used car prices in 2021 to persist and counterparty credit quality to worsen as government support measures for lessees start to be phased out. This is likely to put pressure on key financial metrics, notably residual value (RV)/asset quality and profitability. Commercial fleet lessors showed fairly stable performance in 2020 due to disciplined RV setting, granular and relatively long-dated leases and limited counterparty defaults (which would otherwise require the lessors to repossess and release leased assets in a challenging environment). Strong and geographically diversified franchises of rated fleet lessors support strong earnings generation, allowing them to relatively comfortably absorb pandemic-related charges such as excess depreciation charges from fleet revaluations, IFRS9 impairment charges and moderate net losses from used car sales. Positively, net results from used car sales only account for a small proportion of revenue and used car prices would have to deteriorate materially beyond Fitch’s expectations to have a meaningful negative impact on overall profitability.

The future of aviation is strictly tied to several factors

Fleet lessors reacted to the market dislocation by extending existing leases, moderating fleet purchases and utilising their recently improved sales channels (including digital and cross-border) to mitigate the negative impact on the average used car sales margin. Used car prices recorded modest falls in 2020, a trend which we expect to continue in 2021. However, price pressures are mitigated by deferred new car purchases (also as a result of production interruptions at car manufacturers) and the increasing attractiveness of used cars in cyclical downturns.

Given expected subdued business volumes and continued but more modest profitability, Fitch expects leverage (and risk-weighted capitalisation in the case of LeasePlan Corporation N.V.) to be stable in 2021. Rated lessors have maintained funding access throughout the pandemic and benefit from more reliable funding sources (parental funding in the case of ALD S.A., online retail deposits in the case of LeasePlan) than many other non-bank lenders. While upcoming maturities are relatively sizeable, liquidity is supported by adequate liquidity buffers (which have increased since end-2019) and the cash-generative nature of the lessors’ business models.

What to Watch – Behaviour of Extended Leases; Fleet Electrification

- Weakening payment behaviour of lessees whose contracts have been extended, which could indicate higher repossession volumes and ultimately worsening asset quality.

- RV setting, asset valuation dynamics and sales margins, particularly as the share of electric vehicles (EVs) increases.

Equipment Rental and Leasing: Macroeconomic Uncertainty but Resilience Evident

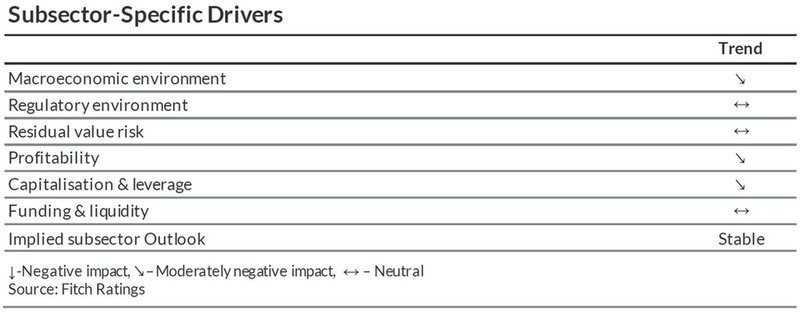

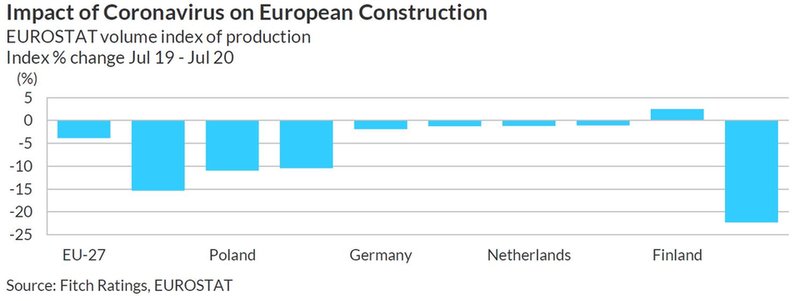

The stable subsector outlook for equipment rental and leasing reflects the view that operating conditions should not deteriorate further relative to the periods of strict regional lockdown experienced during 2020. Uncertainty remains as to the speed of economic recovery in 2021 from the negative effects of the pandemic and demand for lessors’ equipment is inherently linked to activity levels in the sectors they serve. Utilisation levels at Fitch-rated lessors proved sufficiently resilient and adaptable in 2Q20 for the Rating Watch Negatives applied in April to be resolved in the summer with Negative Outlooks as opposed to downgrades.

Scale benefits are likely to become ever more evident in equipment rental, contributing purchasing power, breadth of fleet, brand recognition and the ability to redeploy assets where demand is higher. The sector has undergone consolidation in recent years as large operators have conducted bolt-on acquisitions, as well as Boels acquiring the Helsinki-listed Cramo plc in February 2020. Fitch expects near-term M&A to be slower as issuers conserve liquidity, but we expect growth to return in the longer term with an increasing proportion of end-users choosing to rent equipment.

Utilisation rates for aircraft engine lessors are high, but airlines’ reduced business levels amid the pandemic have led to significant lease deferrals, with a return to 2019 travel levels not expected before 2022.

What to Watch – Speed of Wider Economic Recovery; End-User Diversification

- Economic activity in lessors’ main client sectors and investment in new projects, and the resultant impacts on asset utilisation rates and EBITDA.

- Ability to diversify into complementary sectors to further support business stability and reduce exposure to future cyclicality.

Contact details

Fitch Ratings

30 North Colonnade

London E14 5GN

email: david.pierce@fitchratings.com

website: www.fitchratings.com