UK outlook

What can equipment leasing professionals expect from 2023?

Tim Chapman, the managing director of Hickman Shearer, a UK-based independent capital asset valuation, management and used equipment sales company, offers a few insights into the direction of travel for the equipment leasing sector in 2023.

A

s we cautiously move into 2023, we can be grateful for actively being able to move away from the controls of COVID. However, the adverse impacts of Brexit now seem to be further clouded by the Ukrainian conflict. The resulting impact is ever-increasing energy prices, as well as continued supply chain issues; and now inflation too! All the main economic indicators suggest that 2023 will be a tougher year but how will all this affect equipment lessors?

Tim Chapman,

MD of Hickman Shearer)

In the red and going green

Despite the continued predictions of the insolvency profession that a recession will be upon us with gusto, other measures are suggesting less so than originally feared. Insolvency levels are currently lower than pre-COVID and lessors are not currently reporting any material uptick in defaults or repossessions. As we saw during COVID, government grants are providing limited but important immediate financial support to businesses to ameliorate the energy cost spike. However, SME optimism remains limited and we predict that defaults will worsen.

In the red

It’s now 12 months since the failure of Arena Television and irrespective of the economic landscape, progress should continue in following the recommendations of the Prudential Regulation Authority (PRA) report to bring in improved measures for lessors to:

Inspect and value equipment more diligently;

Work to utilise a database to understand customers’ total asset finance exposure; and to

Co-operate better in managing potential fraud.

These points provide valuable and essential knowledge and insights, particularly if distress does become more commonplace and repossessions more prevalent.

Realistically, most equipment markets currently remain buoyant illustrated by positive demand in the UK, EU and many other global markets. However, keeping these principles in mind, our asset sale team is keeping vigilant and remains prepared to assist lessors in the event of default.

The World Economic Forum)

Going green

Sustainability is everywhere. For the leasing sector, the opportunity to fund green assets will continue to evolve. This is evident across many sectors from the more visible electric vehicles (EVs) and electric light commercial vehicles (eLCVs) to electric site, plant and equipment through to more complex green energy plants.

Despite a higher day-one cost than the current grey alternatives, operational lives being shorter and residual values lower; demand for green assets is growing. However, these factors create their own challenges in structuring terms that reflect the risk but also support customers with their sustainable goals, with the failure of British Volt being a case in point.

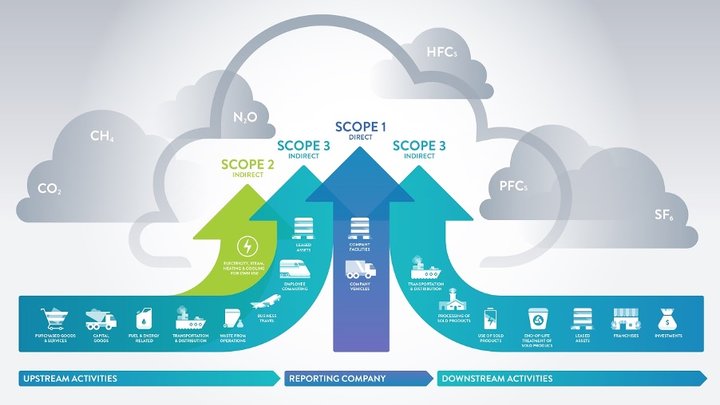

As the leasing industry embraces the opportunities that the transition to a low-carbon economy brings, it is also facing increased regulation that arguably will only become more onerous. The measurement of emissions from equipment leased to customers is at this stage relatively clear.

Moving forwards to the next stage of Scope 3 emissions seems both complex and involved. The challenge of defining emissions that the organisation may not have direct control over, both upstream and downstream of their operations will undoubtedly bring its own challenges. Addressing the challenge of how to assess all the different entities along the supply chain in order to gather their scope 3 data promises to be complicated.

As processes are introduced to measure emissions lenders will be keen to measure and reward customers who succeed in reaching their net-zero targets. But how will carbon-heavy organisations access lease funding in the longer term?

So, in 2023, as funders deal with customers ‘in the red’ and the impacts of failure they will also so be seeking to continue to ‘go green’ by embracing the challenges the new carbon-neutral economy brings.