Thought Leadership

Sponsored by Alfa

The Intersection of Sustainability and Scalability in Asset Finance

In the world of asset financing, the drive to scale up business can come into tension with obligations to drive down emissions. New innovations mean that scalability and sustainability needn’t be mutually exclusive.

Main image credit:

As the world continues to adopt greener practices, the pressure for asset finance providers to operate sustainably has also grown. Simultaneously, they also face the need to scale efficiently to remain competitive in a global economy. Sustainability initiatives include greenhouse gas reporting, reducing carbon emissions, and using energy-efficient resources, while scalability requires the flexibility to grow, adapt, and handle increasing demand. These two goals can seemingly be at odds but, with the right technology tools, they can be effectively combined.

Adopting innovative solutions has become crucial for asset finance providers to merge these objectives successfully. Through strategic financing, companies can invest in energy-efficient machinery, green technologies and processes that not only reduce their environmental impact but also support their growth ambitions.

Asset finance and sustainability

Asset finance plays a pivotal role in supporting businesses looking to scale sustainably. It allows companies to acquire the necessary equipment or technology without having to buy it outright, conserving capital while enabling investments in sustainable assets. This method offers flexibility, as businesses can adapt quickly to market changes without being weighed down by large, up-front capital investments.

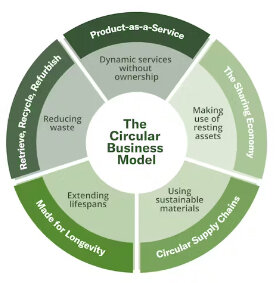

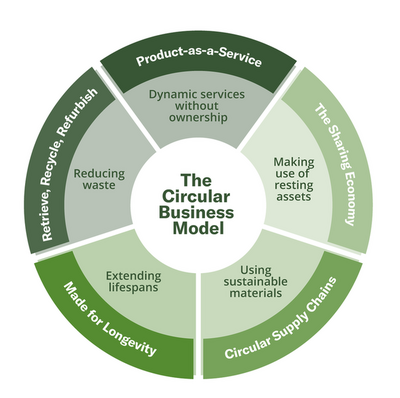

It also encourages companies to rethink their approach to asset lifecycle management. Instead of purchasing equipment that can quickly become obsolete, firms can lease or finance assets that they can upgrade or replace with more efficient, eco-friendly options when needed. This model supports the circular economy, where the focus is on reusing and recycling assets, thereby reducing carbon and waste footprints.

The shift towards asset lifecycle management is a potential game-changer. Companies can better manage their assets over time, ensuring they are operating at peak efficiency and are sustainable throughout their lifecycle. This approach not only aligns with regulatory requirements but also caters to increasing customer expectations for eco-friendly practices.

Regulatory compliance and competitive advantage

As governments and regulatory bodies place increasing pressure on businesses to comply with environmental regulations, the role of asset finance in helping companies meet these standards becomes more important. Innovations in financing not only assist companies in acquiring green assets but also help track their environmental performance, ensuring they meet both local and international regulations.

The ability to remain compliant while being cost-effective is crucial for businesses in the current regulatory environment. As companies expand, they must invest in solutions that not only allow for growth but also keep them aligned with global sustainability targets.

By adopting innovative technology, businesses can turn compliance into a competitive advantage. Consumers are increasingly eco-savvy and companies that can demonstrate a commitment to sustainability are better positioned to win these customers. Furthermore, sustainable practices can result in cost savings, especially in terms of energy efficiency and waste reduction, which ultimately benefit a company's bottom line. An approach that aligns growth with ESG (Environmental, Social, and Governance) criteria increasingly influences investor decisions also.

Growth vs. sustainability?

One of the biggest challenges for businesses is finding the right balance between short-term growth goals and long-term sustainability objectives. Traditionally, companies have prioritised immediate expansion over eco-friendly investments, but this mindset is shifting. More businesses are recognising that sustainability is not just a buzzword but a long-term strategy that can drive profitability and competitive edge.

Technological innovations are key enablers of both sustainability and scalability. With cloud-based platforms, real-time data tracking, and a focus on asset lifecycle management, companies can simultaneously grow and reduce their environmental impact.

Total Originations in Alfa Systems 6

Technological innovations driving change

So what do these innovative finance solutions look like in practice? One prominent solution is Alfa Systems 6. The latest iteration of Alfa’s market-leading SaaS platform for asset finance, it is a case study in how technology can help to bring scalability and sustainability together.

One of the core strengths of Alfa Systems 6 is its dynamic resource optimisation. Utilising cloud-native technologies, the platform provides adaptable resource models ensuring that resources are used efficiently. This both reduces costs and shrinks firms’ environmental footprints. Integration with AWS Aurora's serverless technologies allows for real-time scaling based on demand. This is ideal for seamless new portfolio onboarding, where tooling and automated processes also facilitate the quick and painless transfer onto the platform, reducing downtime and ensuring a smooth transition. Always-on capabilities in Alfa Systems 6 further ensure that digital self-service operations are always available, enhancing customer satisfaction and operational efficiency.

Although geared towards business growth, sustainability sits at the platform’s heart. It enables oversight of the entire lifecycle of assets, from origination to end-of-life. This includes inventory management for reuse, short-term second and third lives for equipment, and streamlined refurbishment processes. By maximising the use of existing assets, finance providers can reduce waste and promote a circular economy.

Alfa Systems 6 also supports subscription models, enabling companies to offer assets on a usage basis and the transition from capital expenditure (CapEx) to operational expenditure (OpEx). For financing on-site renewable energy generation, new energy systems can easily be leased to facilitate the move towards sustainability. And decision-makers in major green transition industries, like EVs, can manage entire fleets at the click of a button.

The Scope 3 emissions calculator allows finance providers to track and report on GHG emissions and the platform's robust governance, risk, and compliance (GRC) processes, certified by ISO 27001 and SOC 2, ensure data security and regulatory compliance, providing transparency and reducing the complexities associated with regulatory requirements.

A path forward

The intersection of sustainability and scalability is no longer just an aspiration but a practical reality for businesses willing to adopt the right technology.

Just as they have done through years of economic uncertainty and geopolitical instability, innovative asset finance continues to provide a firm hand on the commercial tiller. Through continuous innovation and a commitment to environmental stewardship, Alfa Systems 6 exemplifies how technology-driven finance can propel business growth and sustainability forward together.

Contact information

Alfa

Moor Place

1 Fore Street Avenue

London EC2Y 9DT

Email: sales@alfasystems.com

Web: www.alfasystems.com