ARENA TELEVISION

Arena TV’s absconded directors and lessors’ missing millions

Administrators of Arena Television have laid bare what some observers have described as one of the biggest asset-based lending frauds in recent UK memory. Alejandro Gonzalez reports

A

mong the funders hit with losses following the collapse into administration late last year of British broadcaster Arena Television are eight leasing companies with executives on the 16-member board of the Finance & Leasing Association (FLA) trade body.

Before its collapse, Arena Television (and its parent Arena Holdings) had racked up almost £300m in loans from 55 lenders secured against thousands of items of broadcasting equipment that simply did not exist, according to a report for creditors by administrators Kroll.

According to the report: “There is a shortfall of several thousand assets resulting in the liabilities of c.£282m which are not supported by underlying assets as the lenders had been led to believe.”

As part of its fact find, the administrators said: “It is apparent that only nine lenders [of the 55] have any verified broadcast assets supporting their finance agreements. These lenders are owned approximately £100m. These lenders will not be repaid in full … The remaining 46 lenders do not have recourse to any assets underlying their HP agreements.”

The only funds to have been recovered so far have been £2,761 in petty cash, but no “significant” other funds have materialised from company bank accounts, the administrators said.

"The scandal is thought to be one of the biggest alleged frauds in the history of asset-based lending," the Sunday Times told its readers in December.

Among the lenders caught up in the suspected fraud are FLA notables: Shawbrook (with losses of £34.6m), Lombard (£24.2m), Close Brothers (£16.2m), Lloyds (£12.6m), PEAC (£12m), Paragon (£9.6m), Simply (£157k) and Time Finance (£106k).

Experts said the exposures are unlikely to threaten lenders. Even Shawbrook, who is nursing the biggest losses among the group of 55, is understood to be well capitalised and has two private equity partners, BC Partners and Pollen Street Capital, with deep pockets.

John Cronin, a financial analyst for Goodbody, said: "These losses, to the extent they manifest, will be painful for the lenders’ concerned – but the scale of the losses will not, in overall terms, drive material capital dilution from the perspective of the high street banks and specialist lenders or challengers."

Asset verification

Arena went into administration when Close Leasing became aware that the broadcaster’s two directors had, without warning, ceased trading, despite their broadcasting trucks and engineers being deployed across the UK to fulfil their contractual obligations, including the UEFA World Cup qualifier at Wembley between England and Albania on the day Arena's directors pulled the plug.

Behind the scenes, events at Arena had come to a head the week before when Hickman Shearer, working on behalf of a group of Arena’s creditors, made a worrying discovery while undertaking an asset verification and valuation of the broadcaster’s cameras and lenses.

“While attempting to verify a serial number with the equipment manufacturer, [Hickman Shearer] was advised that no such serial number existed. This caused [Hickman Shearer] to query the concern with the lender. The directors appear to have taken the decision to cease trading shortly thereafter,” Kroll reports.

The "abrupt closure of the business,” the "abscondment of the directors,” the "discovery of materially significant liabilities,” the "shortfall of assets" and the "amount of misinformation apparently provided by the directors to certain creditors” identified by Kroll, all suggest a large-scale fraud with the possible collusion of a third party.

The persons of interest to the investigation, unsurprisingly, are Arena’s two directors, Richard Yeowart, founder and owner, and Robert Hopkinson, co-director. Yeowart, according to a December report in the Sunday Times, is “camped out” in the seaside town of Le Touquet, France.

The absence of the directors has prompted a worldwide injunction. "The freezing injunction has been served on all known banks holding accounts in the name of the companies and the directors and on various third parties that may have received monies from the directors or companies or may hold assets on their behalf," Kroll says.

Against this backdrop, the administrators have launched a legal claim against Arena’s directors who are being sued for breach of fiduciary duty.

News of the bad loans at Arena and the absconded directors was made worse in the weeks that followed when administrators told creditors that a sale of the business as a going concern would not be possible and that an asset sale was the next best option for recovering their losses, which even before this news were expected to be minimal.

Outside broadcasting market

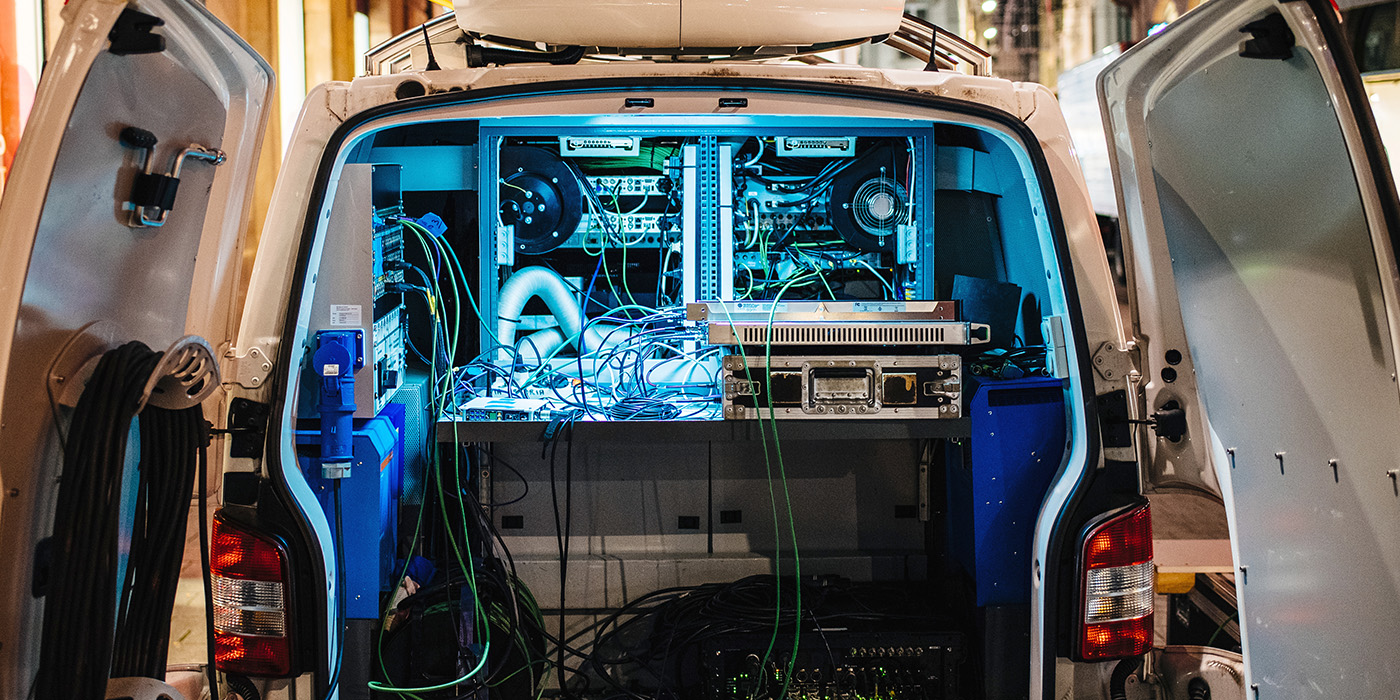

Paul Robson, the managing director of entertainment technology finance provider Medialease, says the outside broadcasting (OB) industry's top clients are Sky, Sky Sports, BT Sport, ITV, BBC, Channel 4 and Channel 5 who collectively control a market valued at, at least, £100m a year, which feeds a market valued well in excess of £10bn in contracts held by broadcast rights holders, predominantly for live sporting events and with big live music events representing a smaller but growing segment.

Steve Knee, the managing director of Cloudbass, a privately owned OB company that employs 80 people across sites in Derby, Surrey and Glasgow, believes the UK OB market is worth about £150m, and possibly as much as £200m.

Industry players describe the OB sector as capital-intensive, highly leveraged and characterised by a preference for hire-purchase equipment finance.

Knee, whose business pulls in £10m in revenue a year, says asset finance has been crucial to the Cloudbass growth story.

"Because the cost of equipment is a barrier to entry, asset finance has been absolutely critical for achieving what we've wanted to do and for leveraging our growth," he says.

In the years after the 2008 financial crash when austerity was the order of the day, Knee embarked on an equipment upgrade from standard definition (SD) to high definition (HD). "After 10 years of running the business on cash and without external financing, we borrowed twice our yearly turnover," recalls Knee. It was a finance strategy that paid off and which he later replicated when the company moved to Ultra High Definition (UHD) equipment.

Up until Arena's exit from the sector, the UK OB market was made up of three main players with another five following some way behind, says Robson.

French-owned EMG, Euro Media Group, is the front runner, controlling 30% of the market, and has grown its UK presence recently through a series of acquisitions. In second place is US-owned NEP UK which has also followed an acquisitions-led growth agenda and has about 30% of the market. Leaving British-owned Arena, which had about 25% of the market. The remaining 15% is held by smaller operators, such as Gravity Media, Cloudbass, Timeline Television and Hayfisher Productions, vying for contracts valued at around £1m or less.

With Arena no longer in the frame, Cloudbass is now the largest independent, dedicated-OB company in the UK, says Knee, "we are currently number three in the UK in terms of size" behind EMG and NEP UK.

A period of market disruption is now expected as OB players compete for Arena’s contracts, and the smaller players will have to snap up Arena’s kit — which the administrators are in the process of selling — to be in with a chance of being able to take on contracts for football, music events, Top Gear and Crufts.

Also, with Arena gone, major rights holders will want to avoid a two-horse race in the UK OB market, says Medialease’s Robson, “which means smaller providers may do well out of this, but only if they can get financing from specialist brokers and banks who've had their fingers burned massively in this sector.”

Financial service providers active in the outside broadcast (OB) sector said the challenge was now about not letting this episode tarnish the industry's reputation for meeting their covenants and debt agreements in the eyes of prospective creditors.

Broadcasting SME bosses, on condition of anonymity, confirmed that in the wake of Arena’s collapse, funders have increased their visibility and asked to review loan documents.

“Lenders have usually been light-touch in terms of due diligence because the sector has always worked that way, but Arena has changed that,” a CEO commented.

One asset finance broker said: “As soon as Arena hit, all the leasing companies went and checked their records to make sure they were comfortable with what they lent out.”

“There have certainly been some responses from lenders in wanting to identify the assets they’ve funded, and I think that will continue, but I do hope there isn’t any fallout in terms of funding in this sector as a result of this bankruptcy,” another broadcasting boss said.

“Arena's problems are not endemic to the industry and we may have to jump through a few more hoops on lending and rates may go up slightly to compensate, and if that is what’s needed to assure our lenders, that’s fine.”