MACHINE LEARNING

The man behind the machine

The role of artificial intelligence, or AI, in asset finance is a growing area, helping providers streamline their decision-making processes, systems and services. Alfa iQ director and Bitfount CEO Blaise Thomson is a pioneer in the development of speech-recognition technology and human-machine conversation. He discusses how machine learning can benefit asset finance and what the risks for the future are

I

would like to tell you the unusual story of how I came into asset finance.

I started my career studying speech recognition and how computers understand speech, which was the subject of Master’s. After this I became interested in how computers can understand language as well. Once you convert speech into text, what does that mean? As with basic speech recognition, with ‘natural language processing’ computers must both recognise and understand words at the same time.

Blaise Thomson, director, Alfa iQ and CEO, Bitfount

Natural Language Processing

Natural Language Processing, or NLP, is a branch of AI that looks at how computers interact with humans using natural language, and studies how to program computers to interpret and analyse dialogue.

Understanding a conversation

Then I got even further interested and I thought, we’re understanding a single sentence, but what about conversation? How can we understand what things mean in conversation? In fact, at every single level we realised that you could use the same language processing methods, over and over, to learn more and more and to build better and better predictors of more complex structures.

A lot of work had already been done on speech recognition. My supervisor, Steve Young, professor of Information Engineering at Cambridge University, had built one of the key toolkits, the HTK toolkit for speech recognition, and had sold it to Microsoft – and speech recognition was by then quite well understood.

Natural language processing was being better understood as well, so for example if you said, “Find me a restaurant”, or “I’m hungry”, in either of those cases, either talking to a personal assistant or to a computer, it’s basically conveying the same information, which is that the system should try and find a restaurant.

But then there was this extra step of moving to conversation where we wanted to handle uncertainty in a better way. So, for example, if you said, “Find me a bus at 7.30”, and the system wasn’t quite sure if you’d said “7.30” or “10.30”, in a true conversation you’d say, “Oh, did you say 7.30?” The person might say “No.” And then the initial listener would probably immediately think “Well, if it wasn’t 7.30, it must have been 10.30”, and that kind of information was something we realised we could also bring into these systems, just by maintaining the uncertainty.

The other unique thing about our company, VocalIQ, was that we realised that we could actually learn what the optimal question was in the conversation, so for example, in this case of uncertainty is it better to just ask again, it is better to ask a confirmation kind of question, so, for example, “Did you say 7.30?” Should you just assume the thing that you thought was the most likely that they’d said? And in different situations different strategies are more effective. And we realised that we could get the computer to learn which question to ask in the conversation at any point and it could optimise it for a particular reward function or value function.

So, that was what I worked on with my first company, VocalIQ, which I spun out of Cambridge after I’d been a research fellow there. And, about a year into the formation of the company – we’d become about 20 people, we’d raised some finance from capital venture firms in Cambridge – and what started happening was that I noticed that the other companies that were building similar tools to us kept being acquired; the first one was a company called Wit.ai, it sold to Facebook, and then another company to Google, and Amazon brought out its Alexa Skills Kit (ASK).

So, I thought our strategy was going to be difficult to follow because our whole premise had been that we could sell licences to our technology or sell access to our tools, but all these other companies were kind of cross-selling their technology and giving away their technology for free in order to sell something else – in Amazon’s case they were just interested in getting people onto their platform to buy products, in Google’s case they want you in so they can market to you and advertise – so, I realised that my strategy had not been ideal for what was actually happening in the market.

Choosing Apple

The second thing was that the market was consolidating. Many industries go through these phases where, especially when a new technology comes out, there are a lot of little companies and then at some point the market starts to consolidate and different companies acquire each another and you get this bigger set of companies. And in our market, most of the biggest players had made their bets – Google, Facebook, Amazon had all acquired companies and so really the only remaining big players were Apple and Samsung.

At that stage I was looking for a second round of funding, and at the same time I realised that we should probably start speaking to potential acquirers, so we chatted to a few people and in the end, we really liked the Apple team, and they made a great offer for us to join them. And so, about a year into the formation of the company we sold to Apple and I joined them and worked there for four years as head of the Cambridge team and the chief architect for Siri Understanding.

The other reason we sold was to do with our ambitions as a company and wanting to make an impact with lots of people using our technology, which we felt was possible through a bigger company, like Apple.

Unearthing hidden value

Asset finance providers – whether they’re bank-backed, captive or otherwise – are becoming increasingly switched on to the idea that technical innovation can accelerate their processes, unify all manner of systems and services, and deliver new business in greater volumes, with refreshing speed and simplicity.

Efficiency and cost reduction have always been key objectives for lessors, particularly those who operate at volume. And while we’ve always found ways to streamline a process here or automate a couple of steps there, there is a new understanding and accessibility around AI which is enabling us to unlock these benefits.

Practically, this can mean unearthing hidden value in data archives, processing new streams of data inexpensively, detecting suspicious behaviour automatically, or responding to market trends more quickly than the competitors.

Machine learning is ideal for identifying patterns in highly complex datasets, automating decisions made on those patterns, then adapting those decisions when new data is presented to it – based on its past decisions. This ability to self-maintain is one of its most valuable properties.

Source: AI in Equipment and Auto Finance, Part I & II (Alfa Systems)

ML and asset finance

About a year and a half ago I left Apple and started looking into asset finance, which you may think is a completely different field to natural language processing, but when I started looking into it, I found a lot of the questions people are asking are very similar.

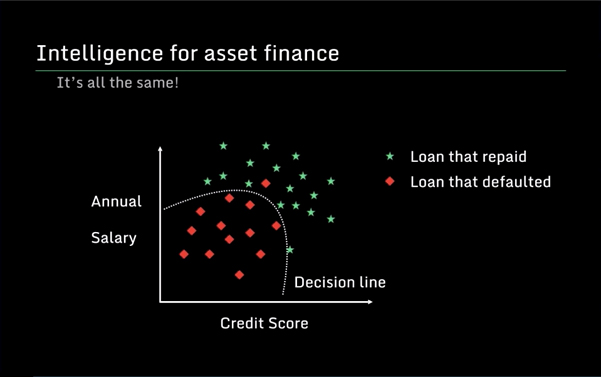

For example, if I’m plotting a credit score on an X axis and someone’s annual salary on the Y axis, it is very similar to the way in which we plot speech patterns on a graph and you essentially end up with same kind of decision problem. For example, if you have ‘loans that repaid’ and ‘loans that defaulted’ plotted on an X and Y axis, it is similar to different sounds plotted on a graph, but now instead of making a decision about whether it’s say an ‘f’ sound or a vowel sound, we’re deciding: will this loan repay or default?

The same system applies to predicting things such as delinquency – trying to predict whether a company or person is going to default after you’ve given them a loan and to work out what the best collection strategy is. You’re just predicting if someone going to default, or in the case of a collection strategy, you’re trying to predict what the return will be for different strategies and then choose the one offering the highest return. This is the same for something like residual values, where you’re predicting how much you’ll be able to get for a car, or piece of equipment, using historical data, or for fraud, where you’re predicting whether a particular loan will turn out to be fraudulent. All of this can be framed in this way as a kind of machine learning problem – and this also applies to things such as ‘invoice anomaly detection’ when you’re doing repairs and maintenance or general risk portfolio management and so on.

Why is this type of machine learning so important?

Our world is changing at an incredible rate, where previously you could just set up a scorecard and assume that the environment and the world would just continue as it has been going, but things change very rapidly nowadays. We’ve got things like Covid, and when Covid happened many people were scared because they didn’t think that the scorecards, or the methods that they had for underwriting, would continue to work.

Why is this type of machine learning so important? Our world is changing at an incredible rate, where previously you could just set up a scorecard and assume that the environment and the world would just continue as it has been going, but things change very rapidly nowadays, we’ve got things like Covid, and when Covid happened many people were scared because they didn’t think that the scorecards, or the methods that they had for underwriting, would continue to work.

And, so when it comes to machine learning you need a much more flexible method, a much more systematic method of building up these predictors. That kind of thing is very common in the tech world, so in any tech company you’re changing the way your system works daily, you’re adjusting your models based on the most recent data. If you think of a company like Google, they need to understand new terms and new search queries immediately, as soon as someone says it. And, at Apple, that was the same for us with Siri – no one talks about “corona” and then suddenly everyone is talking about this new thing that we didn’t even know was a word necessarily, it just happens constantly.

So, when you’re building these machine learning-type models, you need to build in this capability to rapidly adjust to the world. I think that in asset finance the need is actually very similar, it’s been most clearly highlighted by Covid. It’s really something ever present and all over the place. The other thing is that as you build these systems, and run experiments, you’re realising that the faster the system can adjust the higher the accuracy of the system.

When it comes to competition, what I’m seeing is that many tech companies are becoming interested in finance, I think they’re probably not quite caught up to the world of asset finance yet, but the move into banking and financial services is clear. Also, one of the big things I realised after working for a big company is that I really want to see a world made up of lots of different companies, so that people and businesses have options when they need a service or product. It really would be a bad outcome if asset finance ended up being controlled by one big player worldwide. So, it’s important that we, as an industry, respond to the potential for big tech to come in and eat everything up.

As an example, we’ve done some experiments and using machine learning predictive methods we can show excellent improvements for return on assets lent, both on open data sets as well as with our initial customers. If you think about how this might translate over time to a competitive advantage, I think the potential is huge, so you don’t want a big player coming into the industry,

using these new techniques with a huge impact on profitability and capturing the market. There is a risk that they could become so big and have so much data that no-one else could compete. In our case, the impacts I’ve been thinking about only apply to underwriting, but I think business will get huge benefit from this, as well as other parts of the value chain.

It’s important, as an industry, to start adjusting to the new world and to the capabilities that are around and have proven so successful in other areas. I guess I got very excited by these opportunities in asset finance and by a real need, and a social need, to help move the industry forward.

This is an edited version of the keynote address Blaise Thomson gave during the Leasing Life Roundtable Forum on 6 May 2021