Invoices

UK awaits to see the outcome of government late payment review

The industry has responded to the government about its late payments schedule

In October 2018, the UK government launched a call for evidence in tackling late payments, which closed at the end of December.

It’s been a long time complaint of SMEs that late invoices are crippling their ability to operate or grow. But it was the Carillion collapse at the start of 2018 that really revealed the true extent of the national late payments problem, with some suppliers complaining of a 120 day wait to get paid.

Even in the case of invoice finance, lenders will demand certain covenants for payment scheduled on invoices. It’s in the interest of the invoice finance industry that protection for SMEs with regard to payments is looked at by the government.

Kelly Tolhurst, MP, minister for small business, consumers and corporate responsibility said the government had halved late payment debts between 2012 and 2017, but said Carillion had evidenced that more work was needed.

“Small and medium-sized businesses are disproportionately affected by late payment. Because of their size they may be less able to cover financial shortfalls, find temporary finance more difficult and more expensive to obtain and have less robust credit management systems,” she wrote.

“Late payment can therefore prevent a business from investing in opportunities to grow. In addition, payment terms beyond 60 days are unacceptable.”

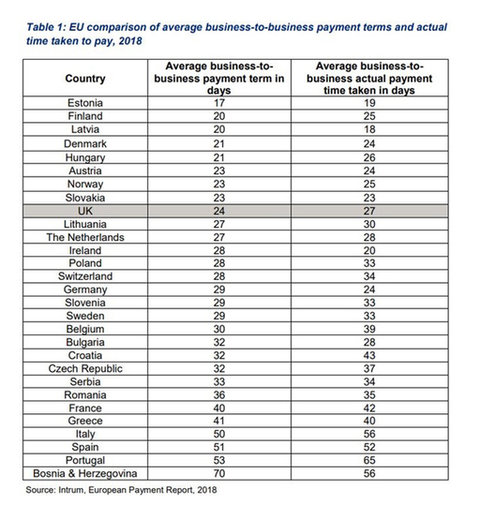

Table 1 shows how the UK sits with average payment terms and actual payment terms across Europe for SMEs.

While the data from the European Payment Report (Table 1) might not accurately reflect the actual practice in the field, it is a good reference-point for how the payment landscape is across Europe.

Carl D’Ammassa, group managing director, Business Finance at Aldermore, said despite statistics in the Department of Business Energy and Industrial Strategy’s latest call for evidence showing that late payments practices are declining, it was essential that the government continued to stamp out the UK’s bad late-payment behaviour and support British business.

“We welcome the BEIS Committee’s recommendation of introducing a statutory requirement for companies to pay within 30 days, however to combat the issue further, we have recommended the introduction of a robust reporting system with a significant financial penalty incurred by those who fall below minimum standards.

“This will make the level of late payments specifically to SMEs clearer and highlight those regular offenders, preventing them from being able to hide these statistics in an average payment metric. The money collected from late payments fines should then be invested back into SMEs through a development fund, potentially overseen by the British Business Bank.”