THOUGHT LEADERSHIP

Sponsored by Fitch Ratings

2020 Outlook: Commercial Fleet Leasing – Western Europe and North America

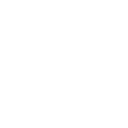

Fitch Ratings’ 2020 Outlook for commercial fleet leasing companies is stable in both Western Europe and North America, supported by resilient financial profiles including appropriate risk-adjusted leverage, continued fleet management outsourcing by lessees, and manageable interest rate sensitivity. These supportive trends are counterbalanced by an expected resumption of residual value pressures and, where lessors operate also in emerging markets, the potential for currency and/or operating environment volatility. This whitepaper will provide further insight into Fitch’s subsector outlooks for Western European and North American commercial fleet leasing companies.

Generally Resilient Business Models and Financial Profiles

Commercial fleet lessors’ performance remains in most cases supported by consistent core operating cash flows, which benefit from sound operating leverage. Fitch expects modest portfolio growth for commercial fleet lessors in 2020, driven by increased fleet management outsourcing due to the rising costs and complexity of managing fleet ownership. In Europe, this is supplemented by comparatively fast growth in auxiliary private leasing products.

Fitch views commercial fleet lessors as having a less cyclical business model than other large equipment lessors, as they have a greater focus on essential services and benefit from a shorter order-to-delivery cycle. Interest rate sensitivity is relatively limited as lessors seek to mitigate this risk by issuing term debt to match-fund lease terms. In the case of shorter-term lease or rental contracts, lessors have the ability to pass higher funding costs on to customers fairly quickly via revised lease rates. Leverage is mitigated by relatively high quality and diverse client bases, which have given rise to low loss experience over time.

Pressure on Used Vehicle Values

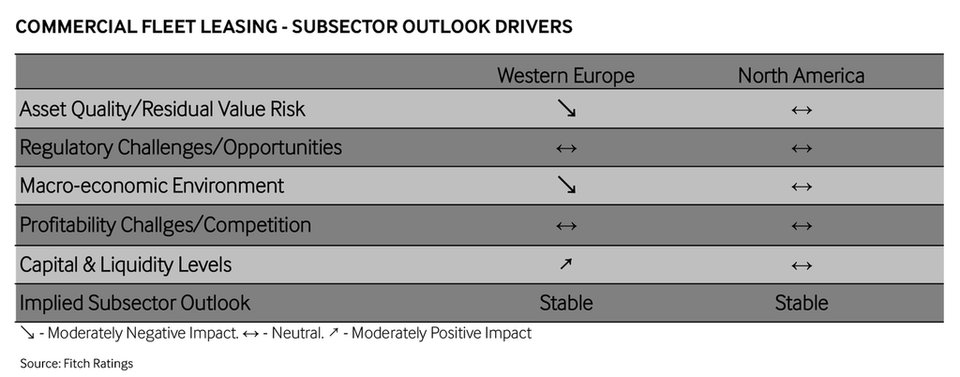

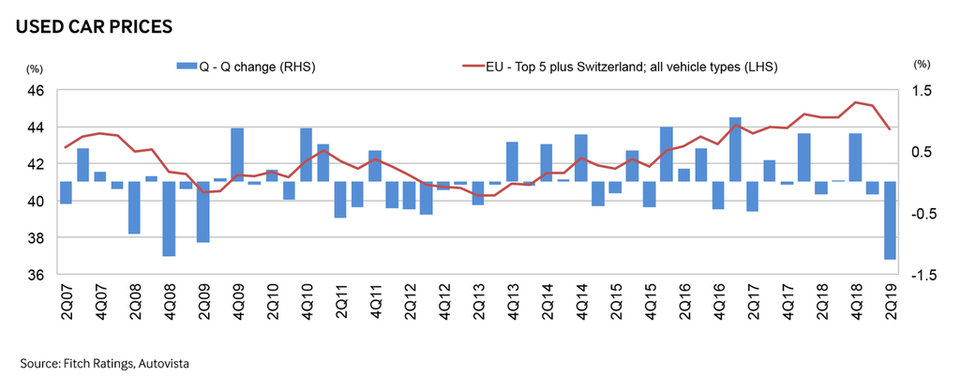

Used vehicle prices have shown recent signs of deterioration in both North America and Western Europe, although this should be seen against the backdrop of a generally favourable environment in recent years. The downward trend is of greater significance in Western Europe, where lessors are typically exposed to residual value risk via the market preference for closed-end leases, whereas North American fleet lessors almost exclusively employ open-end lease terms.

Used car prices in major European markets fell in 1H19, particularly in the UK, and Fitch does not expect recovery in 2020. Car registrations in the EU in 1H19 were 3% lower year-on-year, largely due to a more cautious economic environment and the growth in alternative powertrains not fully compensating for a reduction in diesel engines. However, fleet lessors’ profitability is expected to remain adequate due to their resilient core leasing earnings, despite the lower contribution from vehicle disposals.

In North America, wholesale used vehicle prices have demonstrated generally solid performance, as evidenced by the Black Book Used Vehicle Retention Index, which ended September 2019 at 115.9, down from 116.0 a year earlier. However, used vehicle prices have begun to show weakness, as wholesale auctions for cars and light duty trucks have reported declines of 0.25% and 0.39%, month over month in August and September 2019, respectively, in volume-weighted average wholesale values. Fitch expects continued downward pressure on used vehicle prices over the medium term given modest weakness in wholesale prices, but the impact on earnings should be moderate, as a result of the use of open-end leases.

Emerging Markets Volatility Can Also Affect Developed Market Lessors

Large European fleet lessors have pan-European (if not global) franchises, and hence some exposure to emerging market risks. This supports overall business growth, but also increases currency and credit volatility, as illustrated by the sharp depreciation of the Turkish Lira in 2018. However, European fleet lessors’ credit exposure remains more focused on mature European markets and the US, such that any ongoing emerging markets volatility should remain manageable. North American lessors’ activities are largely within their domestic markets.

What to Watch

Commercial fleet lessors in North America and Western Europe are exposed to increasing downward pressure on used vehicle prices, but Fitch expects fleet management outsourcing to continue due to the growing complexity of fleet ownership. Interest rate sensitivity should remain manageable, given match-funding to underlying lease terms.

European fleet lessors have greater need to adapt their business models to structural changes, including a sharp projected increase in alternative powertrains, corporate car sharing and changes to asset disposal channels. However, given their scale and operating leverage, Fitch believes that rated fleet lessors are well placed to respond to these challenges.

To learn more about Fitch Ratings, visit www.fitchratings.com