Thought Leadership

Sponsored by Fitch Ratings

Fitch Ratings 2022 Outlook: EMEA Developed Markets Fleet Leasing and Equipment Rental

Commercial Fleet Lessors

Modest New Business Growth; Robust Used Car Sales Result

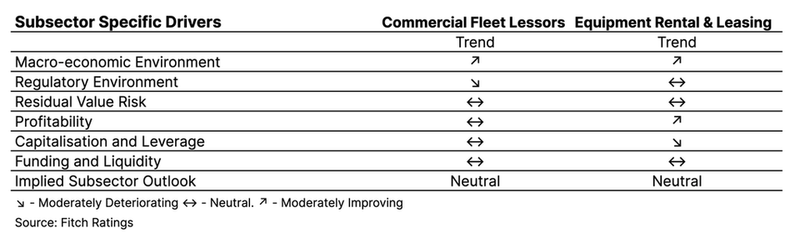

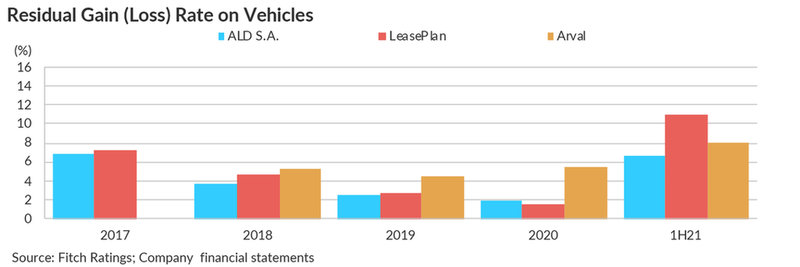

For 2022, we expect new business growth to improve moderately, which should support resilience in core leasing earnings, thereby balancing an expected normalisation in net used vehicle sales gains. In 2021, new business growth was modest for most rated peers, affected by uncertain economic conditions as well as by supply constraints for new vehicles (associated in particular with the shortage of semiconductor microchips). Profitability, however, has been sound, as buoyant demand for second-hand vehicles underpinned strong used car sales results.

Resilient Asset Quality Supports Credit Profile Stability

Asset quality for fleet lessors held up reasonably well in 2021, supported in particular by disciplined residual value (RV) setting and good quality counterparty credit profiles underlying the leasing exposures - the bulk of which pertain to closed-end contracts. With market dynamics having normalised in recent months, we see limited risk for additional impairment charges in 2022. While RV risk-setting for electric vehicles (EVs) entails some short-term uncertainties (given limited historic datapoints), this is mitigated by the gradual increase in EV assets in lessors’ fleets.

Stable but Elevated Leverage

Subdued fleet growth, and consequently lower funding needs, as well as modest capital accumulation (which in the case of LeasePlan was underpinned by dividend moratorium guidelines issued by the European Central Bank) have led to improved balance sheet leverage ratios for most issuers. For 2022, we anticipate leverage remaining stable as funding needs increase only gradually against the backdrop of steadily easing supply constraints for new vehicles. Over the longer term, leverage for most fleet lessors will likely remain elevated, especially as the gradual introduction of more costly EVs drives higher fleet funding costs on a per unit basis.

Demonstrated Funding Access; Good Cash Generation

Despite the pandemic, funding access for rated lessors has remained robust, benefiting either from good parental funding provision (in the cases of ALD, Arval and Leasys) or diversified funding profiles (in the case of LeasePlan this includes reasonably stable retail deposits and broad capital markets access). While upcoming maturities are relatively sizeable, liquidity is supported by adequate liquidity buffers (which have increased since end-2019) and the cash-generative nature of the lessors’ business models.

What to Watch

- Shared mobility concepts and changing vehicle utilisation preferences present both longer term opportunities (enhancing leasing penetration) and challenges (the migration of clients).

- As meaningful organic growth prospects are limited across most markets, mergers among large independent lessors could materialise to rival the market dominance of large captive fleet lessors in their respective domestic markets.

Equipment Rental and Leasing Companies

Improving Macroeconomic Climate to Support Equipment Investment

The stable subsector outlook reflects our view that rising economic activity in the wake of pandemic restrictions should give rise to strong demand for lessors’ equipment and provide good growth opportunities. These positive trends may be tempered to a degree by increased leverage as lessors invest further in their fleets, but for rated issuers this process has typically been well-managed over time. Fitch uses gross debt/EBITDA to assess rental companies’ leverage and increased EBITDA should contain the impact of the higher borrowings needed to fund investment.

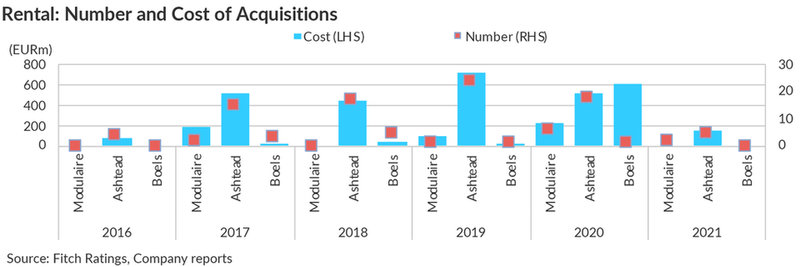

Rental: Capex to Rise, Subject to Supply

We expect capital expenditure (capex)to rise, as rental firms renew investment in fleets which have been allowed to age since 1Q20. In a downturn, lower capex is a means for rental firms to conserve liquidity while continuing to generate cash flows from assets already owned, and many postponed discretionary elements of expenditure during the pandemic. The pace of investment may itself be softened by supply chain issues but larger rated lessors typically have higher purchasing power. We also expect M&A to return as lessors pursue bolt-on acquisitions to broaden their niche expertise, as well as expanding their footprint via new greenfield sites.

Rental: User Movement Away from Ownership To Continue

The 2020-21 downturn is likely to leave many equipment users facing cash flow constraints on their capacity to purchase major assets. Fitch expects this to support the trend already visible before the pandemic of users choosing instead to rent equipment, benefiting from flexibility in periods of use without incurring significant upfront capital outlay. Lessors could, for similar reasons, face some increased credit risk, but this is limited by the retention of ownership of the underlying equipment.

What to Watch:

- Sustained supply issues which delay lessors’ ability to rent out ordered equipment.

- Any reversal of recent economic reopenings which delays development projects and crowd events.

To find out more about Fitch’s ratings on leasing and equipment rental companies visit https://www.fitchratings.com/non-bank-financial-institutions

The future of aviation is strictly tied to several factors

Contact details