Oleg’s new capabilities are in three areas: saving, recurring payments and fast credit card payments. The skills developed for Oleg aim to simplify payment processes for Tinkoff SuperApp users. For example, he can set spending limits or remind customers about recurring payments.

If a customer tells the voice assistant, “Oleg, let’s save” in the Tinkoff app chat, Oleg can set up regular spending limits as dictated by the customer. If the customer is in danger of surpassing their daily, weekly or monthly budget, the voice assistant notifies them.

Recognising manual but recurring payments, Oleg can also now send a reminder to ensure that they are timely. Oleg can also assist the customer in making the payment immediately. Speaking to RBI, Konstantin Markelov, Tinkoff’s Vice President of Business Technologies, comments: “This skill has a very good conversion rate, as 10% of all our push messages come to a payment. This is not a spam for customers – it is useful for them.”

Furthermore, Oleg can now make quick credit card payments. Saying “Oleg, check my credit card” means that the assistant will present the customer with the minimum card payment, the grace period payment and the total debt. Without leaving the chat with Oleg, the customer can tell the voice assistant how much they want to pay, which account and settle the transaction there and then.

How Oleg helps Tinkoff customers

Markelov tells us: “Oleg uses smart recognition to save money, keep your finance in good shape and to help you achieve financial goals and be financially successful.”

The advice given by Oleg is informed by SuperApp customers themselves. “We know how 10 million customers live their lives and if they’re financially successful or not”, says Markelov. “For example, we can say to customers interested in buying an iPhone: customers with income like yours normally wouldn’t buy an iPhone, or you should buy one in two months, or in instalments.”

About Tinkoff and Oleg the voice assistant

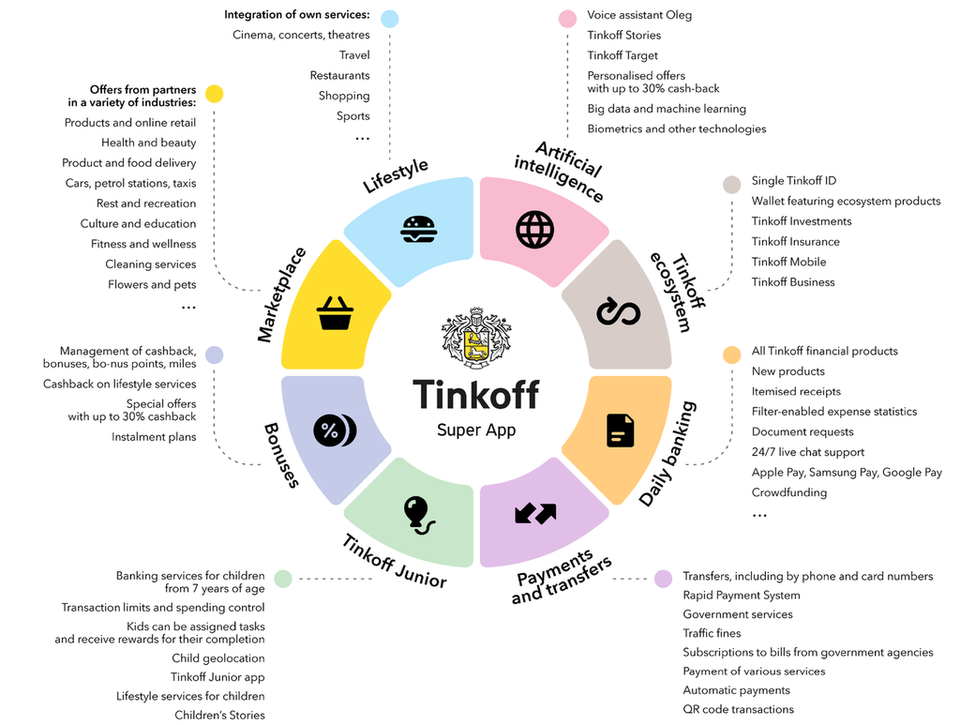

Tinkoff is a branchless online financial ecosystem, centred around lifestyle banking. The bank was awarded European Bank of the Year by RBI at our 35th annual RBI global awards in June. It helps customers review and organise personal spending, invest savings, obtain loyalty card bonuses and make reservations – for example, book a restaurant or a cinema trip. Tinkoff provides its services through its app and its website.

Launched in June 2019, Oleg is a personal voice assistant designed to help Tinkoff customers with their daily routines. It attempts to do this through certain learned actions. These operations include:

paying phone bills

paying credit card bills

presenting the customer's income and expenses

advising on financial issues

requesting and e-mailing documents

updating personal information in Tinkoff

talking about several subjects.

Tinkoff claims that for Tinkoff Mobile subscribers, Oleg is able to answer calls and talk and joke with the caller, translating audio messages into written text.

What next?

Tinkoff sees a bright future for Oleg. According to Tinkoff, we can expect Oleg to be able to update customers on financial news, remind them about important payments and assist customers in adhering to a budget. Tinkoff also claims to be working on customer voice recognition so that Oleg can perform tasks that would otherwise need authorisation in the app. Other plans for capabilities include making appointments, buying tickets, selecting and booking trips and offering evening leisure options.

“Customers spend a lot of time on different apps – shopping on one, and planning holidays on another,” says Markelov. “Oleg can help them do these things through our apps.” Oleg will be able to inform Tinkoff customers of discounts, cashback or ways to save by making payments within the Tinkoff SuperApp. With numerous apps within the SuperApp, Oleg could facilitate many aspects of customers’ lives, including investing and buying shares.

Markelov tells RBI that the next steps for Tinkoff involve finding out why customers do not use the SuperApp and its services like Oleg when there are discounts available in the SuperApp. Then, using artificial intelligence, it will work to focus on five pillars for its three to five-year strategy. These comprise making good suggestions and recommendations; automatisation of paying bills and saving money; total personalisation, where Tinkoff will predict what a customer is going to do when they enter the app; gamification and socialisation of its services; and of course, Oleg, the voice assistant.

Share

Share this article