By Julian Hobbs, CEO, Commercial Finance, Siemens Financial Services, UK

Introducing Gen Z

At a time when disruptive events continue to resonate around the globe, achieving environmental, social and governance (ESG) targets is looking like an even tougher task than before. The challenges are myriadi – driven by geopolitical conflict, fossil fuel supply, supply chain disruptions and inflationary pressures.

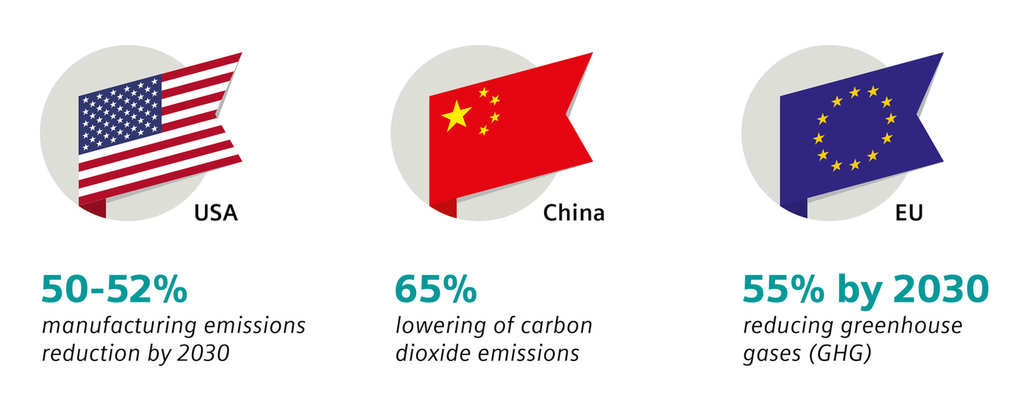

Nevertheless, there can be no rowing back. Major economies across the globe have made substantial commitments to improving environmental sustainability in the face of climate change. Here in the UK, the Government published new mandatory climate targetsii, followed up with its long-awaited Environmental Improvement Plan (EIP) for Englandiii – published on 31 January this year. It constitutes a five-year delivery plan to restore nature and improve the environmental quality of the air, waters, and land. The US presidential statement back in April 2021 committed to reducing manufacturing emissions by 50-52% by 2030iv. In a speech that same year, the Chinese President pledged a lowering of carbon dioxide emissions per unit of GDP by 65% from 2005 levels. And in Europe, EU law sets an intermediate target of reducing greenhouse gases (GHG) by at least 55% by 2030 compared to 1990 levelsv.

UK targets

It is interesting that the UK’s EIP specifically describes itself as “Our delivery plan for the environment, building a greener, more prosperous country.” This description neatly tells us that sustainability improvement is not merely a moral obligationvi. In reality, analysts are focused on the commercial imperatives behind sustainability. Talking about the manufacturing sector, Deloittevii notes that it is “…rarely conflated with environmental best practices. Perceptions, however, are not always accurate. In truth, manufacturers around the world are generating substantial financial and environmental benefits from sustainable manufacturing.” This underlines the UK Government’s description of its environmental plan quoted above. Sustainability improvements are capable of delivering better business. Moreover, companies who do not measure, monitor and improve their sustainability credentials are also likely to damage their own market position. In Europe, for instance, there is already a proposal to clean up supply chains worldwide and make business sustainableviii. So, ignoring the issue is likely to undermine future competitiveness.

Standards – inspiration from the capital markets

In a world where we are all seeking to make our business more sustainable, one issue stands out – how can we ensure that companies’ claims are credible? For some guidance we can look at the world of corporate finance. If financial instruments – such as bonds or funds – make green and sustainable claims, then it is critical to investors that these claims are credible. Although global standards in this field is still a work in progress, it is well advanced and not far from completion.

Attempts have been made to define and standardise green bonds – globally through the Climate Bond Initiative – and in the highly developed European market through the EU Green Bond Standard, and the EU Taxonomy. The markets are clearly determined to flush out rogue elements. A watershed study from late 2022 found that “Green bond fund managers are rejecting a fifth of green bonds on sustainability grounds as quality concerns in the market continueix.” Commentators in the published study talk about the need to “flush out ‘opportunistic’ issuance.” Yet they summarise the situation by saying “that overall quality was ‘relatively good’ despite the market operating on voluntary principles, and that increased regulation going forward is likely to improve standardisation and transparency.”

European Authorities have also issued a call for input on how to prevent greenwashingx.

Flushing out greenwashing

The UK’s Financial Conduct Authority (FCA) expresses similar quality concerns over claims in some instances. The FCA notesxi that it has highlighted evidencexii of firms making exaggerated, misleading or unsubstantiated sustainability-related claims about their investment products. This ‘greenwashing’, is a challenge that has been testing regulators across a range of industries. To address such concerns the FCA, in its proposed rules, has set out a sustainability labelling and classification system for investment products, along with disclosure requirements for asset managers and investment products.”

To address such concerns the FCA, in its proposed rules, has set out a sustainability labelling and classification system for investment products, along with disclosure requirements for asset managers and investment products.“

All this is actually immensely positive. The situation is not a crisis of confidence, but more a recognition that increasingly stringent standards and scrutiny are necessary to fuel increasing market growth going forward.

Once these standards are finalised and policed (and there have already been prosecutions for greenwashing in the financial marketsxiii) then they can also provide an agreed framework for general sustainability initiatives – whether designed to raise capital on the public markets or not.

Sustainability in asset finance

If we move then, from the heady heights of the capital markets back into the world of everyday operational business finance, the same principles apply.

We know from direct experience at Siemens Financial Services (SFS), that smart flexible finance is playing a crucial role in enabling investment in, more sustainable manufacturing, energy-efficient healthcare and smart buildings. The real mission is to deploy smart finance to actually move the dial on investment in more environmentally friendly technology solutions. For instance, a leading glass fibre product manufacturer in the North West turned to Siemens to analyse factory processes and recommend a strategic approach to enhancing its energy use. After a full assessment of the facility, Siemens identified key areas where processes and equipment could be implemented to refine efficiency. Working us at SFS, Siemens were then able make the solution cash-flow friendly, deploying a tailored financing structure that allowed them to guarantee the expected savings over the course of the 5 year contract.

There is huge opportunity (and pressure!) to enable very substantial green and sustainable improvements – particularly in the manufacturing sector which represents some 17% of UK greenhouse gas emissions.

Ultimately, if smart finance can accelerate adoption, this is what will be most valued by customers – a credible contribution to making our world more sustainable. Especially at a time when there is huge opportunity (and pressure!) to enable very substantial green and sustainable improvements – particularly in the manufacturing sector which represents some 17% of UK greenhouse gas emissionsxiv.

Innovative financing for sustainability

Interestingly for Siemens Financial Services, we are one of the few financiers who are very close to the underlying digitalised technologies that are enabling real, measurable sustainable gains for business. In fact, I would go so far as to say that these emerging areas for ‘sustainability enabling’ finance are very much the province of specialist, tech-savvy players like ourselves. Indeed, market knowledge and digital connectivity to the assets we finance is already helping us to work towards more tailored those financing structures.

Yet even for a specialist like us, new disciplines are required. For instance, we are focusing on enabling energy production which sits ‘behind the meter’. This means larger energy users who want to invest in plant that helps them generate their own electricity on-site. The risk profile in these cases is easier to assess because the customer organisation has a clear and provable idea of the energy they consume. Yet even here, we know we have to spend much more detailed attention, more due diligence, on shaking out the claims of the technology provider. We mitigate risk by making sure we understand the reality behind the technologists’ marketing!

Conclusion: a strategic investment

In conclusion, the business finance industry stands at a crossroads. Getting sustainability-enabling products/services into the market is hard work and must be done meticulously, purposefully. And smart finance should be a lever that moves the dial to enable real progress and acceleration in sustainable technology adoption. A close eye needs to be kept on emerging standards. And companies must assess the entirety of their operations, resisting the temptation to cherry-pick. Getting it right will be a competitive gain that will repay the investment of time and intelligence year after year as the next decades unfold.

i https://www.forbes.com/sites/prakashdolsak/2022/02/23/ukraine-crisis-is-terrible-news-for-climate-policy/

ii https://www.gov.uk/government/news/new-legally-binding-environment-targets-set-out

iii https://www.gov.uk/government/publications/environmental-improvement-plan

iv https://www.whitehouse.gov/briefing-room/statements-releases/2021/04/22/fact-sheet-president-biden-sets-2030-greenhouse-gas-pollution-reductiontarget-aimed-at-creating-good-paying-union-jobs-and-securing-u-s-leadership-on-clean-energy-technologies/

v https://ec.europa.eu/clima/eu-action/european-green-deal_en

vi Forbes, Sustainability should be the right choice morally, not just commercially, 14 Apr 2021

vii Deloitte, Sustainable manufacturing, from vision to action, 2021 https://www2.deloitte.com/global/en/pages/energy-and-resources/articles/sustainabilityin-the-manufacturing-sector.html

viii https://www.oxfam.org/en/press-releases/new-eu-proposal-sustainable-business-needs-fixing-work-people-and-planet

ix https://www.responsible-investor.com/fund-managers-rejecting-a-fifth-of-green-bonds-as-quality-concerns-continue/

x https://www.esma.europa.eu/press-news/esma-news/esas-launch-joint-call-evidence-greenwashing

xi https://www.fca.org.uk/publications/research/matter-fact-sheets-improving-consumer-comprehension-financial-sustainability-disclosures

xii https://www.fca.org.uk/publication/correspondence/dear-chair-letter-authorised-esg-sustainable-investment-funds.pdf

xiii https://www.reuters.com/business/finance/deutsche-banks-dws-sued-by-consumer-group-over-alleged-greenwashing-2022-10-24/

xiv https://www.gov.uk/government/collections/uk-territorial-greenhouse-gas-emissions-national-statistics