Thought Leadership

Sponsored by Fitch Ratings

Fitch: European Lessors Pass Pandemic-Related Stress Test

Pandemic Highlights Business Model Resilience

Fitch Ratings’ concerns about negative pandemic related pressures on residual values (RVs) and associated impairment charges and losses related to necessary asset disposals for rated operating lessors have abated. Over the medium-term the sector outlook is now supported by both cyclical and structural factors, increasing leasing penetration rates with downside risks being rapid technological change and an uneven post-pandemic economic recovery.

At the onset of the pandemic sensitivity analyses stressing net gains (or losses) from asset disposals, lessee defaults and sharply slower business volumes pointed to lessors or rental companies with high fleet turnover and/or short lease or rental contracts being at risk. As a result, Fitch placed a number of equipment rental companies on “rating watch negative” in early 2020 with rating downgrades in the short-term a distinct possibility.

Ultimately, negative rating actions were less pronounced than anticipated and only three out of 23 rated leasing and rental companies in EMEA remain on “negative outlook” as of early October 2021. While some of the sectors’ better-than-expected performance was clearly due to extraordinary government support measures (limiting counterparty defaults and the need for asset re-marketing) as well as unexpected tailwinds due to supply shortages (notably in the automotive sector), the pandemic also highlighted the relative resilience of lessor business and RV forecasting models.

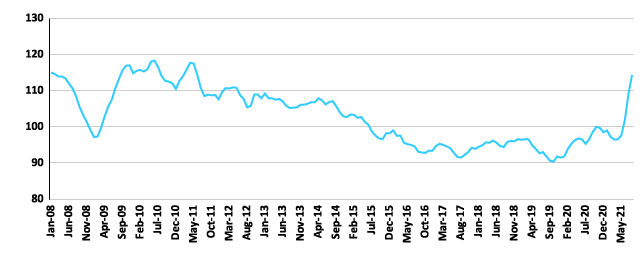

UK Second-Hand Cars CPI Index

(2015=100)

Source: Fitch Ratings, UK Office for National Statistics

RV Models pass stress test

Government support measures for lessees and lease extensions helped limit asset repossessions and reduced pressure on asset values in the early period of the pandemic. Sectors such as equipment rental and modular space leasing have additionally benefited from structural features (such as asset return logistics and the often infrastructure-critical nature of the assets), supporting utilisation rates and leasing and/or rental revenue.

While cash revenue in many cases suffered from deferrals of lease or rental payments for struggling lessees, operating cash flows generally remained positive. Proactive management actions to conserve liquidity by reducing capital expenditure for assets purchases was key. Excess fleet depreciation and direct impairment charges were contained with most lessors reporting positive net asset disposals results for 2020 as a whole with small net disposal losses reported in the second and third quarter of 2020. This shows the appropriateness of their depreciation policy, often underpinned by their exposure to generally newer, more in-demand assets.

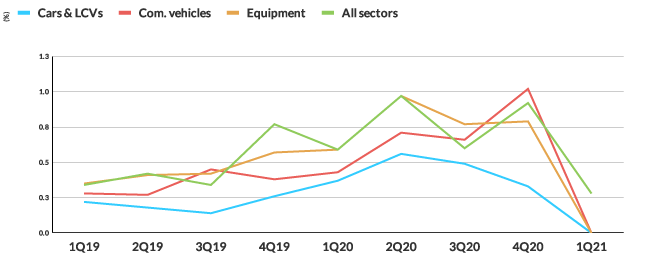

Cost of Risk Peaks in 2020

(Annualised impairments/weighted avg. portfolio)

Source: Fitch Ratings, Leaseurope

The future of aviation is strictly tied to several factors

Varying Degrees of Business Model Leveragability

Fitch covers a broad range of leasing asset classes with varying degrees of market size, market maturity, leasing penetration and quality of lessees. While leverage tolerance is company-specific, Fitch typically has a higher leverage tolerance for business models with low exposure to RV risk, good cash flow stability due to limited variability in lease and utilisation rates and low reliance on net asset sales results. While RV models differ across sectors, we believe a number of factors, beyond a prudent depreciation policy relative to an asset’s useful economic life, are relevant for all asset classes when assessing RV exposure and cash flow stability for operating leasing and rental companies. Key factors include asset disposal timing, asset liquidity, price volatility and counterparty credit quality.

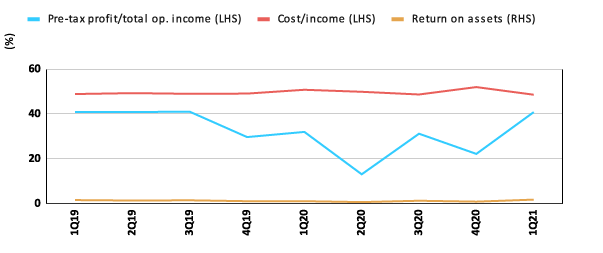

Profitability Recovers in 2021

(All Leaseurope members)

Source: Fitch Ratings, Leaseurope: weighted average

European rolling stock leasing companies utilise assets for most of their useful economic life (mitigating RV exposure related to disposal timing), invest in assets with comparatively lower price volatility and typically lease long-term to public or quasi-public sector entities which drastically reduces the likelihood of unscheduled re-marketing events. Combined, this results in lower RV exposure and higher leverage tolerance compared to most other leasing sectors.

Structural features at equipment rental companies are considerably weaker with much shorter rental terms, a larger proportion of annual asset disposals and generally weaker lessee counterparties. The resulting higher RV exposure is partly mitigated by well-functioning secondary markets and the rental companies’ ability to rapidly reduce capital expenditure for fleet purchases due to limited committed purchases and the generally moderate ticket size of fleet assets.

Automotive fleet lessors are exposed to high levels of annual asset disposal needs early in an asset’s economic life and only average counterparty credit quality. RV exposure is however reduced because of a liquid vehicle secondary market, well-established disposal channels and in some cases buy-back agreements with vehicle manufacturers.

RVs Challenged by Technological Change

RV models in many sectors will in future be tested by rapid technological and societal change, making RV calculations and pricing more challenging. In particular, automotive leasing where the share of electric vehicles is projected to increase sharply and changing mobility patterns (e.g. ride- sharing) will require adjustments to current RV models.

However, rated European lessors are generally well placed to manage these changes. This is due to their focus on younger assets (less at risk of being immediate replaced by new technology), the gradual introduction of new technology assets and in most cases the lengthy expected roll-out period for disruptive technology.

The future of aviation is strictly tied to several factors

Contact details

Christian Kuendig

christian.kuendig@fitchratings.com

+44 20 3530 1399

www.fitchratings.com